Increase Your Ecommerce Store’s Revenue with “Buy Now, Pay Later”

Irene Wanja | Feb 07, 2022

Reading Time: 5 minutesHello! Jeremy Friedland from Build Grow Scale here. I’m a Revenue Optimization™ expert and also one of the lead trainers for Ecommerce Business Blueprint, an awesome training on how to build a new ecom store and brand from the ground up.

In today’s video, we’re going to talk about “Buy now, pay later” (BNPL) options for your store and how they can benefit your bottom line.

Not Just for Expensive Products

A lot of people think BNPL is typically reserved for higher-end products … which is true in some cases, but I’ve also seen it benefit lower-end products like print-on-demand t-shirts, mugs, and stuff like that. No matter the demographic, people will always prefer to pay over time if they can. And if it comes down to them either bouncing from your site or paying a monthly payment, they will choose the monthly payment if they love the product.

So, if you’re not offering “Buy now, pay later” currently, I’m going to give you some options to choose from—there are a lot of them out there—to help you implement it on your ecommerce store. I highly encourage you to do so no matter what price point your products are, because there are people out there who want to pay for a $33 t-shirt over multiple payments. And if you can help them buy your product and make them feel good about it, they’ll come back and continue to purchase from you.

Pro: Skip the Liability

The biggest benefit of using BNPL apps or services is that they take on the liability if a customer chooses not to fulfill all of their payments. So, if someone buys something from your store, chooses to buy now and pay later, and then after two payments decides they’re not going to pay anymore, the BNPL company will actually go after them for the money they owe.

The only caveat to that is if you didn’t deliver the product or the customer never received it, that onus is going to be on you. But if you have an ecom store and want to stay in business, you’re probably delivering the products your customers order, in which case, BNPL is a win-win for all parties.

Con: Higher Service Fee

Now, there is a downside to the “Buy now, pay later” option, and that’s that the app or service fee is usually pretty high, which cuts into your margins quite a bit. But, like I mentioned above, you get the benefit of them going after the customer if they stop paying, so the companies offset those liability costs by charging you more for the service. Different companies charge different fees, but it’s often something like $0.30 plus a percentage of the sale, which is typically somewhere in the 7-8% range (although some go as low as 4%). Depending on the volume you do, you may be able to negotiate that rate a bit.

Real-Life Example

I can talk numbers and tell you how great BNPL options are all day, but I like to back up my statements with actual proof, so let’s look at some real-life data from one of our clients. This store offers “Buy now, pay later,” and I’m going to show you the following data from their Google Analytics account:

- Number of people who click on the widget to view more about the BNPL program

- How they buy

- Total number of purchases made via the BNPL option

So, let’s dive in!

Google Analytics

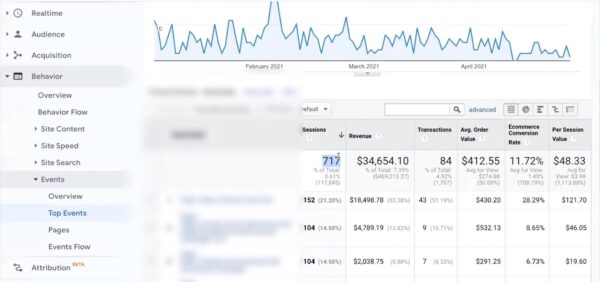

Now, one really important thing I want to mention first is that if you’re not using Google Tag Manager (GTM) to track the actions on your website, I highly recommend implementing it right away. Get a developer to do that for you and start tagging all of the events that happen on your site so you know how your users’ behavior affects your website’s revenue. That’s how I was able to set up tags to see what actions people take after they click on this store’s Klarna (BNPL app) banners.

So, below is the Google Analytics account for this client, and you’ll see that we’re on the “Events” tab (“Behavior” > “Events”) in the left-hand navigation menu.

Under the “Events” tab I have “Klarna Product Page” and “Klarna Banner.” There’s a banner on the site that shows up and people click on that, but the majority of the action happens on the Klarna product page widget. Underneath the description, I have a widget that tells the customer the item is going to cost four payments of $99, or four payments of $24.99, or whatever it is. The app automatically adjusts the payments according to the product that they’re looking at. You’ll notice this particular store has gotten 866 total events year to date.

So, let’s go ahead and click on the “Klarna Product Page” event, and then on the “Ecommerce”’ tab to see what kind of sales this store is getting.

The cool thing is that this is an 11.72% percent conversion rate (almost 12% of people that click on this option take it), which is approximately five times the average conversion rate for this store. That’s huge! So, the BNPL option brought in $34,654, which is about 7.5% of their average revenue.

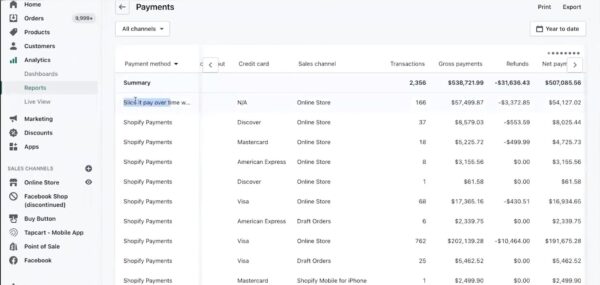

Shopify Analytics

Now, when we dive into the Shopify analytics, we can see that “Slice it pay over time” (a Klarna payment method) has made nearly $58,000 in total sales over 166 transactions. So, instead of $34,654, we’re talking about $23,000 more sales overall, which equals about 12% of their total revenue and an almost 12% conversion rate, just by offering the option to pay over time.

Wrap-up

As you can see from the information and example presented in this article, providing a “Buy now, pay later” option on your ecom store is insanely valuable, and something you should be doing (if you’re not, implement it today). It helps your customers afford the products they want, allows you to make a sale, and the BNPL company makes a commission to boot. Not only that, but it’s free to add the app to your store. You only get charged the commission fee when someone makes a purchase. So, it truly is a win-win-win situation and is sure to add some impressive revenue to your bottom line.

That’s the training for today, I hope you enjoyed it! And if you’d like to hear more about what Build Grow Scale does or you’re interested in finding out how we can help you build, grow, or scale your ecommerce business, go to workwithbgs.com and schedule a free strategy session with one of our Revenue Optimization™ experts. We’d love to hear from you!

About the author

Irene Wanja

Irene, a skilled Revenue Optimization Specialist for Build Grow Scale, combines an unparalleled focus on user research and a deep understanding of the ecommerce customer journey to orchestrate optimal shopping experiences. With an uncanny knack for detecting and addressing customer pain points through meticulous user testing, she utilizes tools such as moderated user tests, heatmaps, scrollmaps, and clickmaps to fast-track improvements in user experience and usability. Her keen eye for detail aids in swiftly spotting potential issues and implementing solutions, all while working closely with store owners and applying her intricate comprehension of user interactions. Passionate about software and technology, Irene immerses herself in enhancing her clients' business clarity, efficiency, and user satisfaction. Even though the value of user experience doesn't conform to a conventional numerical scale, the tangible outcomes of her work—improved user experience, amplified retention rates, and reduced customer support issues—are testaments to her prowess. Beyond her revenue optimization skills, Irene is a skilled writer and copywriter. She weaves her profound insights into engaging prose, crafting content that not only resonates with diverse audiences but also demystifies the complexities of user experience, consequently benefitting businesses worldwide.